WineBusiness Profile.

View your Winejobs activity.

Not a member? Create an Account

Members receive a FREE subscription to the Daily News Email. Join 30,000+ daily readers.

select news topic

{{news.title}}

{{news.subtitle}}

{{news.title}}

{{news.subtitle}}

WINEJOBS

{{wj.dateString}} | {{wj.locCity.toLowerCase()}}, {{wj.locState.toLowerCase()}}

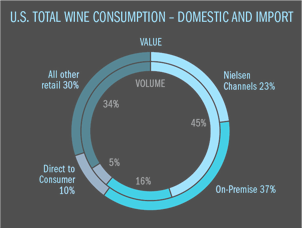

ANALYTICS

The Wine Analytics Report is a monthly, digital report on the U.S. wine industry produced by the editorial team at Wines Vines Analytics

and based on information from proprietary databases and data supplied by partner research firms.

CLASSIFIEDS

Lastest Listings

{{listing.sectionTitle.toLowerCase()}} - {{listing.dateString}}